Why Interest Rates Matter: Understanding the Federal Reserve

Source: Invesco

The Federal Reserve Bank, commonly referred to as The Fed, plays a pivotal role in shaping the United States’ economy. One of its most visible and influential tools is the setting of interest rates, which impacts not only financial markets but also the daily lives of Americans. By adjusting interest rates, the Fed aims to strike a balance between economic growth, employment, and inflation.

The History and Structure of the Federal Reserve

The Fed serves as the central bank of the United States, although almost every country has its own central banking system and/or governing body. The Federal Reserve was established in 1913 through the Federal Reserve Act in response to recurring banking panics that destabilized the U.S. financial system, such as the Panic of 1907, which served as a direct catalyst for the creation of the Fed. Its establishment aimed to provide a safer, more flexible, and stable monetary and financial system. The system comprises the Board of Governors in Washington, D.C., and twelve regional Federal Reserve Banks situated across the country. This decentralized structure allows for both national oversight and local input into monetary policy.

The Fed exists for what’s known as a “dual mandate”, or its two primary goals: maximize employment and maintain stable prices. The moderation of interest rates is how these objectives get done. Importantly, the Fed operates independently within government, meaning its monetary policy decisions are not subject to direct approval by Congress or the President. This independence is considered vital to ensuring that economic reasons rather than political reasons guide monetary policy.

Why Interest Rates Matter

Interest rates represent the cost of borrowing money or the return on savings. They are central to both personal finance and the macroeconomy. For individuals, interest rates determine mortgage payments, credit card costs, and student loan burdens, as well as the returns on savings accounts. For businesses, borrowing costs influence investment decisions and hiring plans.

At the national level, the Federal Reserve uses interest rates to guide economic activity. Lowering rates makes borrowing more affordable, encouraging consumers and firms to spend and invest more, thereby stimulating economic growth. Conversely, raising rates can help slow inflation by cooling spending and borrowing. The impact extends broadly: consumer behavior, inflation trends, labor markets, and financial markets are all shaped by Fed interest rate policies.

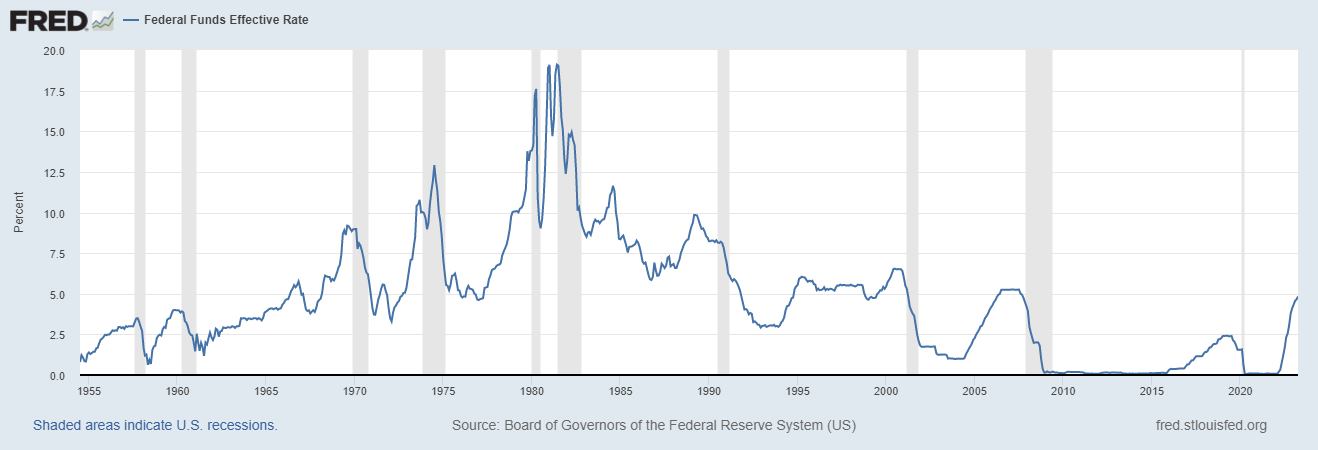

Source: FRED

How the Fed Sets Interest Rates

The key tool for the Fed's ability to influence interest rates is the money supply. When the Fed wants to raise interest rates, it makes money scarcer in the banking system. One way it achieves this is through open market operations, which involve selling U.S. Treasury securities that it holds. This is known as monetary policy.

When banks and investors buy those Treasuries, cash leaves the financial system and moves onto the Fed’s balance sheet. With fewer reserves available, banks have less to lend, which drives up the cost of borrowing — in other words, interest rates rise. At the same time, when more Treasuries hit the market, their prices fall and their yields (the effective interest rate) increase.

Conversely, if the Fed wants to lower interest rates, it buys Treasury securities, increasing the amount of cash in banks’ reserves. With more money available to lend, the cost of borrowing falls.

Rate Cuts and Political Pressure

This year, the Fed has faced political pressure, particularly from President Donald Trump, who has urged the Fed to cut rates more aggressively. Trump’s criticism has raised concerns about the independence of the central bank, an institution designed to be insulated from political interference. Despite this, the Fed recently announced a rate cut in September, citing economic uncertainties and the need to support growth.

For consumers, this cut translates into slightly lower borrowing costs. While the move may stimulate demand, it also carries the risk of fueling inflation if rates remain low for too long.

Global and Domestic Implications

Changes in U.S. interest rates reverberate globally. Lower rates tend to weaken the dollar as Treasury bonds become less attractive to foreign investors, which reduces demand for U.S. dollars and lowers the currency’s value. This makes American goods cheaper for overseas buyers, boosting exports, but it also makes imports more expensive for U.S. consumers, who need more dollars to buy the same foreign products. They also influence global capital flows, as investors seek higher returns in other countries. For emerging markets, U.S. rate cuts can provide “breathing room” by easing debt burdens denominated in dollars.

For college students, lower rates can reduce the cost of student loans and ease borrowing burdens, but they may also signal economic challenges. The Fed typically cuts rates when economic growth is slowing and unemployment is rising, which could impact job prospects after graduation.

Theoretical Perspectives and Limits of Monetary Policy

Economists have long debated the power and limits of central banking. As noted by Bakija and Slemrod (2017), monetary policy is often the first line of defense against recessions because it can be implemented more quickly than fiscal measures such as government spending programs or tax changes, which require legislative approval.

However, there are limits to how far rate cuts can go. At the “zero lower bound,” when nominal interest rates approach zero, the Fed cannot cut rates further to stimulate growth. This situation, known as a liquidity trap, was highlighted by John Maynard Keynes in The General Theory of Employment (1937). Keynes argued that when business and consumer confidence is weak, even zero interest rates may not spur consumer spending and new business investment. In such cases, fiscal policy, including government spending and taxation, becomes necessary to revive economic activity.

Conclusion

By raising or lowering interest rates, the Federal Reserve influences borrowing, spending, and investment in the U.S., with consequences that are felt worldwide. From stabilizing inflation to influencing job markets, the Fed’s decisions affect everyone, from Wall Street investors to college students managing student loans. Ultimately, understanding the Fed and its rates is essential to grasping how modern economies are managed and how policies translate into real-world impacts.