Netflix’s Reinvention: From Growth Obsession to Profit Discipline

Source: freestocks

In April 2022, Netflix shocked Wall Street by reporting its first subscriber loss in more than a decade. The news wiped out nearly $50 billion in market value in a single day, forcing investors to ask a question once unthinkable: had the streaming pioneer’s growth story finally peaked? For a company that had long defined the future of entertainment, the moment marked a turning point and set the stage for one of the most important strategy pivots in its history.

The Rise of Netflix

Netflix, founded in 1997, began as a small-scale DVD rental delivery service company founded by Reed Hastings and Marc Randolph. In 2007, they pivoted into an online streaming platform, a decision that would transform the entertainment industry and reshape how people consumed television and film at home. As a result, cable TV lost its dominance, video rental stores began to decline, and streaming platforms with ad-free access and on-demand viewing of entire libraries of shows and movies became the premier way to watch TV. With this shift, Netflix continued to develop its streaming platform at a fast pace, but with that high growth came a high price. Netflix invested billions in producing original content, chasing what would become its prior major hits, such as House of Cards, Stranger Things, and The Crown. Moving their product internationally fueled subscriber growth, but it also amounted to large amounts of debt: by 2021, Netflix had over $14 billion in debt as a result of its original content creation efforts. These issues went unaccounted for, and for a while, investors didn’t mind; subscriber numbers continued to rise, and the company still grew.

The Strain of Debt and Rising Rivals

Unfortunately, the good times came to a halt. By 2022, Netflix reported its first subscriber loss in over a decade, causing its stock to tumble by more than 35% on April 20, 2022, following the company's earnings report release the previous day. The drop marked a turning point, raising doubts about whether Netflix’s growth model could continue indefinitely. Competitors like Disney+, HBO Max, Hulu, Amazon Prime Video, and Apple TV have flooded the market, each spending heavily to win over subscribers. The streaming landscape had become saturated, with consumers faced with too many options and rising subscription fatigue. Growth in the U.S. slowed, content costs increased, and Netflix’s debt continued to compound. Netflix's identity as a consistently growing company suddenly seemed unsustainable.

The Turn Toward Profitability

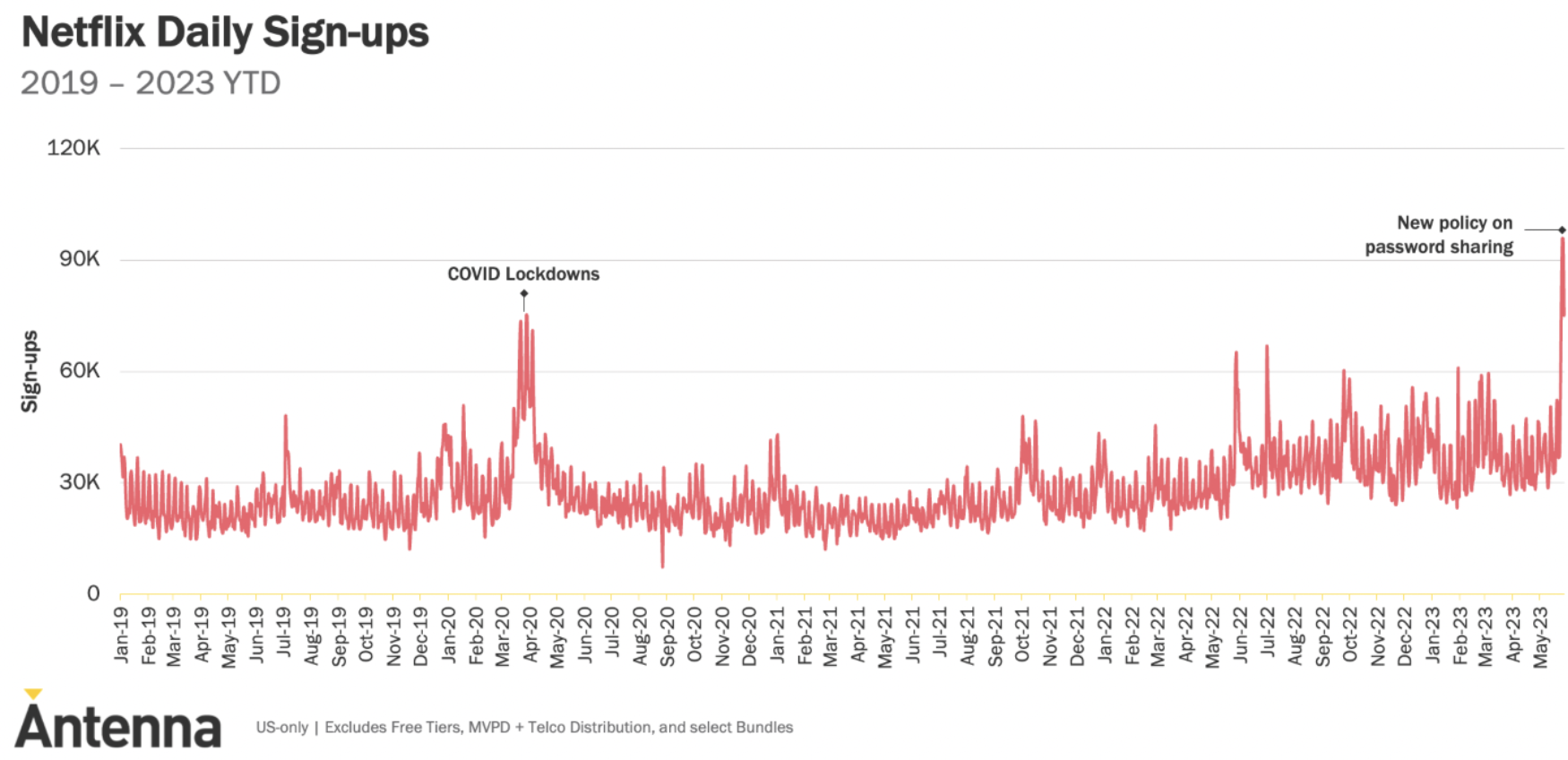

Under pressure from investors, Netflix decided to shift its strategy from focusing on growth to prioritizing profitability. Three moves defined this shift. First, in 2023, Netflix launched a crackdown on password sharing. Millions of households that once benefited from others' accounts suddenly had to pay for them. Instead of backlash driving users away, the strategy proved effective, resulting in millions of new subscriptions worldwide.

Source: Antenna

Second, Netflix embraced advertising. After long resisting advertisements, the company launched a cheaper ad-supported option in late 2022. Advertisers, eager for Netflix’s huge audience, signed on quickly. By 2024, the advertisement option was contributing meaningful revenue and positioning Netflix to better compete with other streamers, even pulling from traditional TV ad dollars.

Third, Netflix became more disciplined with content. Instead of endlessly chasing blockbuster originals, it leaned into proven global hits, such as Korean dramas, Spanish-language thrillers, and reality shows, which deliver strong returns at lower costs.

Together, these moves reassured investors. What once looked like a fragile growth story began to resemble a sustainable business, striking a balance between innovation and financial discipline.

The Bigger Lesson

Netflix’s evolution offers a clear lesson in business adaptability and reinvention. The company recognized that its old model of rapid growth fueled by debt and endless spending was no longer successful in a crowded streaming market. By advertising, cracking down on password sharing, and experimenting with new formats like pay-per-view, Netflix found fresh ways to grow revenue while controlling costs. For the broader economy, the company illustrates how fast-growing firms must eventually shift from chasing scale at all costs to building sustainable, profitable models.

At the same time, Netflix still has significant room to grow. As cord-cutting accelerates and global demand for streaming rises, the company is positioned to capture new audiences worldwide. The challenge will be to stay disciplined, continuing to innovate within financial limits rather than repeating past cycles of overspending. Netflix’s story shows not that growth is over, but that lasting success comes from striking a balance between ambition and discipline.

The Risks Ahead

Netflix’s new strategy isn’t risk-free. The ad-supported model could make the company seem less like a premium alternative to cable, which is often critiqued for its long advertisements. Additionally, competitors like Disney+ and Prime Video continue to pose strong competition, each with extensive content libraries, a global reach, and substantial financial backing. However, Netflix’s most recent shifts to a sustainably diverse business may be its most important yet. Whether through ads or password crackdowns, Netflix is showing how adaptability can keep a company not just alive, but ahead of the competition.

Source: NPR