The AWS Outage and the Hidden Costs of Digital Monopolies

Introduction: A Wake-Up Call for the Digital Economy

This October, the world experienced a rude awakening regarding the presence of monopolies and oligopolies within society when Amazon Web Services unexpectedly suffered a widespread outage. As a result of this occurrence, a multitude of platforms reaching across social media, academic, and financial domains experienced failures, most notably including Snapchat, Glow, Reddit, Fortnite, Roblox, and Venmo. While experiencing temporary technical difficulties with any of these apps is not uncommon, the scale and reach of this particular event caused much larger-scale problems, raising questions about who should be able to operate as a monopoly or oligopoly and why.

Source: Aljazeera

Monopolies, Oligopolies, and AWS’s Evolving Role

According to United States antitrust laws, monopolies can exist under three circumstances: as a public franchise, through patents and copyrights, and via natural monopolies. As businesses and society as a whole begin to rely increasingly on a small number of cloud-service providers, the role of AWS in the global economy has evolved beyond that of a typical tech vendor to the point where it now operates as an almost form of infrastructure. As a result of this, AWS has begun to function as a sort of public utility, granting it and a few other competitors oligopoly status as the cloud-service provider market begins to function like that of a natural resource due to the extremely high initial fixed costs associated with entering the industry.

AWS’s Market Influence and the Power of Digital Oligopolies

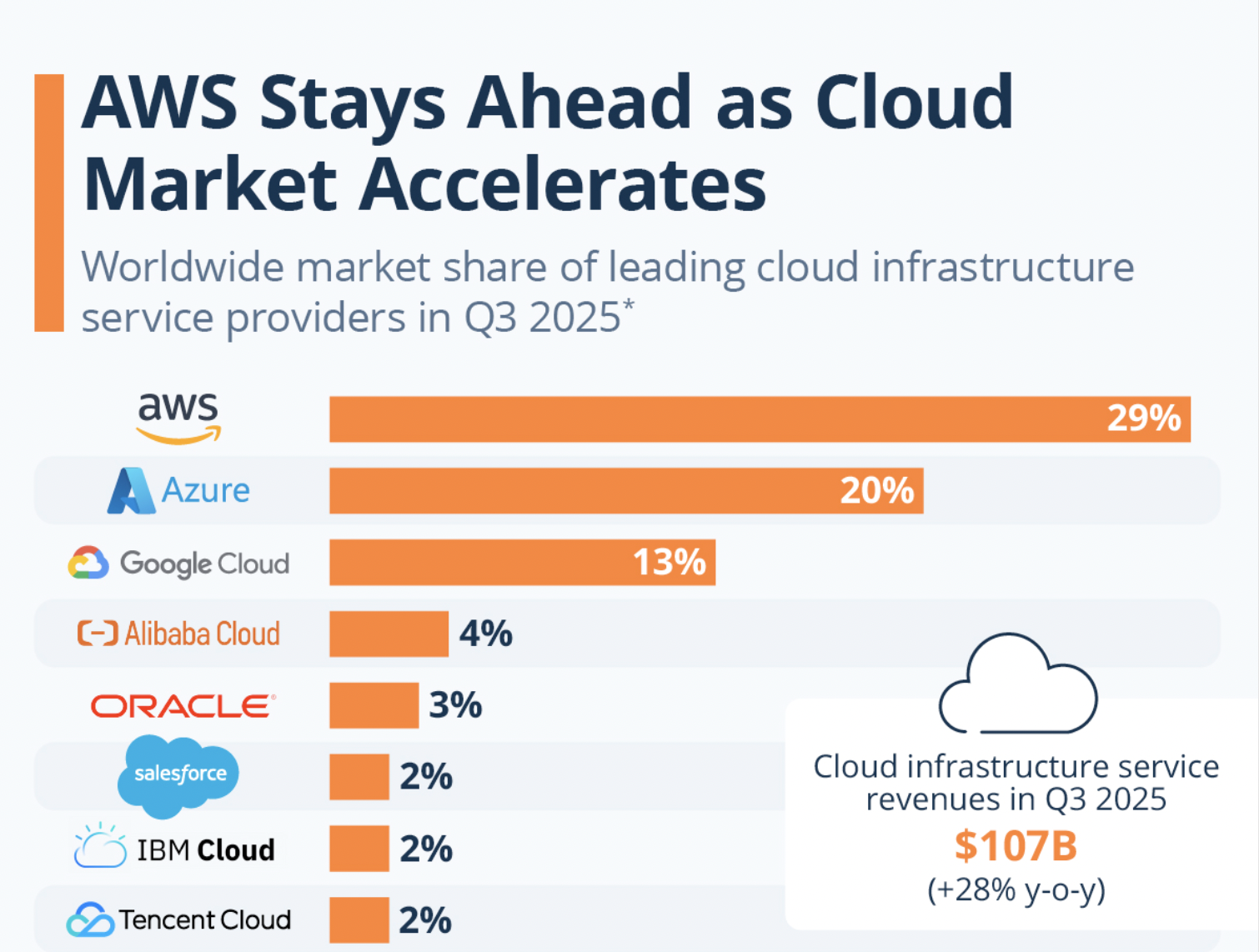

Although AWS is precluded from being considered a complete monopoly by its competition with a few other notable firms, such as Google Cloud and Microsoft Azure, its influence within the market is still quite substantial. AWS’s infrastructure serves as the backbone of millions of websites and apps for companies across the globe. This command of the market is not inherently problematic due to the benefits associated with oligopolies, including lower costs, more efficient production, and increased innovation. However, this level of market control does mean that the consequences of what could have otherwise been considered a small technical mishap are amplified across multiple businesses, industries, and countries, as was experienced this past month.

Source: Statista

Technical Cause of the Outage

The outage that was experienced has been traced back to a failure in one of AWS’s core systems, affecting Domain Name System (DNS) resolution and several other major services hosted primarily in its heavily used US-EAST-1 region. This region, one of AWS’s most established, handles a disproportionate share of global workloads. As a result of the US-EAST-1 region’s long-established legacy of dependability, many developers default to it, causing a single point of failure to emerge unintentionally over time. When that point failed, it triggered a cascade of service interruptions, greatly inconveniencing users and exposing how deeply embedded AWS has become in everyday digital operations.

Monopoly-Like Dependence Goes Beyond Market Share

This raises an important question: Is AWS functioning as a monopolistic force in the cloud market? As has been established, legally, AWS is not a monopoly due to the competition it experiences. Yet the technical definition of a monopoly via market share is only one dimension of monopoly-like influence, and other factors, such as systemic dependency, must be considered as well. As was demonstrated through the outage, even companies that do not use AWS directly can be affected if the services they depend on, such as payment systems or communication tools, run on AWS. In this sense, AWS’s influence resembles that of a monopoly, as the internet’s well-being relies heavily on the stability and decisions of that one firm.

Business Implications

For businesses, the AWS crash forced a reckoning, as many technology teams realized that they lack sufficient contingency plans. While cloud computing has long been marketed as resilient and flexible, the convenience of relying on a single provider has created a sense of false complacency. Companies that built systems exclusively on AWS found themselves effectively immobilized during the outage, and even those with backup systems elsewhere discovered that switching between cloud environments is far more complex than expected. As a result, a growing number of analysts are now arguing for distributing workloads across multiple providers. However, implementing multi-cloud systems is expensive and technically demanding, placing smaller businesses at a disadvantage and potentially increasing companies’ dependencies on AWS in the long run.

Should Cloud Providers Be Treated as Utilities?

From a regulatory standpoint, the outage sparked fresh debate about whether cloud providers should be treated as critical infrastructure. If AWS functions similarly to a national utility, should it not be regulated as such? Supporters of increased regulation argue that governments should require cloud providers to meet higher standards for redundancy, transparency, and reliability. Some propose “cloud stress tests” similar to those used in the banking industry. On the other hand, critics warn that over-regulation could hinder innovation, slow down development, or unfairly target successful companies. Others argue that breaking up cloud companies would be impractical and might not reduce systemic risk, since the complexity of cloud systems creates vulnerabilities, even in more competitive markets.

Conclusion: The Risks of Centralized Digital Infrastructure

At its core, the AWS outage serves as a case study in the dangers of centralized digital infrastructure. It illustrates how modern monopolies operate not through price controls or visible market domination, but through deep systemic dependency. Businesses must reassess their resilience strategies, and policymakers should consider whether new oversight measures are necessary. Monopolistic power in the digital age is not only about market control, but the fragility of global systems built on privately owned infrastructure. Until organizations diversify their systems and governments rethink regulatory frameworks, potential future outages like this will continue to expose the vulnerabilities of our interconnected digital world.