Why the Boom of Artificial Intelligence Might Cause the Next Recession and Change Businesses Forever

Over the past couple of years, artificial intelligence has become the hottest market in the global economy. With over $1 trillion dollars invested in artificial intelligence, it seems right to assume our economy is headed into a new direction. Virtually all Fortune 500 companies in the American economy have invested in artificial intelligence, some reaching hundreds of billions invested like Google and Amazon. If all this money invested is backed by the most influential companies in the world, why hasn’t artificial intelligence produced profit, let alone broken even? What does this suggest about the state of our economy?

Parallels of Artificial Intelligence with the Internet Thirty Years ago

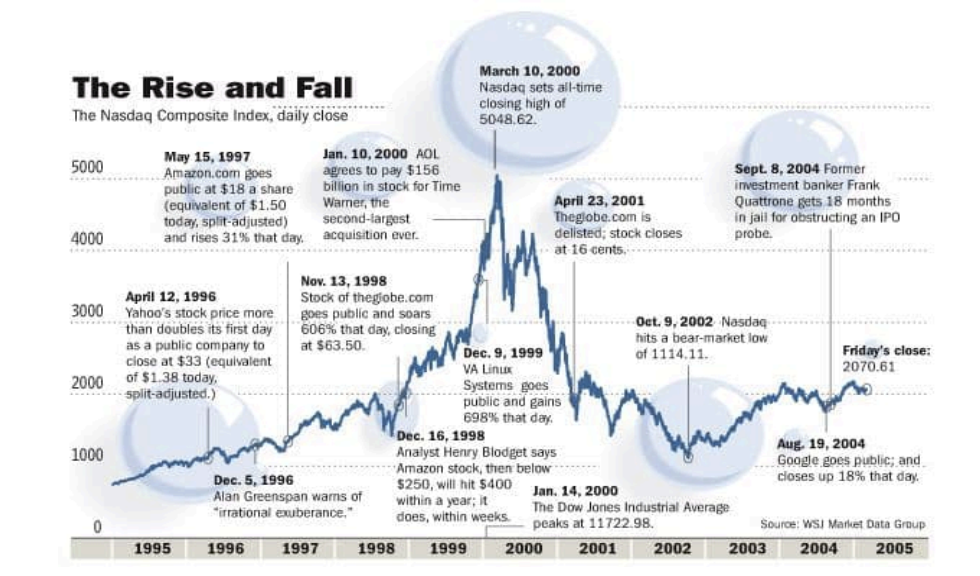

The growth of artificial intelligence is the most interesting phenomenon in technology since the creation of the internet. The start of the internet shows similarity with the valuation of artificial intelligence today. In the 1990s, the speculation of the internet’s profitability shifted the market's focus on publicly traded internet companies. The height of the internet’s overvaluation generated only $21 billion in revenue compared to the colossal $451 billion valuation. The stock market collapse of 2000 followed this dotcom bubble, with the Nasdaq falling 78%, and internet investors losing approximately $5 trillion. Many experts have noticed the similarities between the hype of Artificial Intelligence and the beginning of the Internet. Eventually, the internet proved to be profitable, but is there a way we can avoid pain with the same long-term growth of AI.

Source: WSJ Market Group

Overvaluation with Artificial Intelligence

Unfortunately, the AI market is following the same trend as the internet thirty years ago. Over the past couple of years, companies like OpenAI, Oracle, and Nvidia have gone on spending sprees for data centers, chip manufacturing, and land. Some examples, like OpenAI’s recent Stargate program, dedicate $500 billion to infrastructure over the next four years. Despite the excitement from the massive deal, the project will only generate $13 billion by 2028. Even though this deal requires much capital, it is insignificant to how much OpenAI has spent. In 2025 alone, OpenAI has negotiated $1 trillion in deals with other AI companies and chip manufacturers. Because of these deals in the AI industry, it has created a web of AI companies that are most likely to mitigate risk. According to Bain & Company, the financing needed to fund the infrastructure is $2 trillion in revenue annually. Currently, the AI market is short $800 billion of that mark, demonstrating the extent of risky financing for AI. Coreweaver CEO Mike Intrator says “If you’re building something that accelerates the economy and has fundamental value to the world, the world will find ways to finance an enormous amount of business,” at the Wall Street Journal Tech Conference. Intrator downplays the overspending allegations with the immense demand for AI. However, the idea that demand will eventually finance the spending isn’t good enough to suggest we aren’t going down a risky path.

Source: Morgan Stanley Research

Is it right to replace human jobs with Artificial Intelligence?

Artificial Intelligence is the future for production, but is it right to substitute humans for something not real? The implementation of AI will not only cause short-term pain but will also create market shifts for white collar workers. Major businesses are already seeing AI take many jobs, and with the improvement, 30% of all jobs are estimated to be automated by 2030. Goldman Sachs estimates that by 2045 50% of all jobs will be replaced by AI, removing 300 million jobs globally. Businesses will value AI as technology breakthroughs will reduce costs, giving a more efficient and cheaper alternative. J.P. Morgan CEO Jamie Dimon says that he will not be surprised if AI replaces many repetitive tasks in 15 years. How will this market shift affect businesses and the economy?

Conclusion

As investments grow with Artificial Intelligence, the chances of a recession increase. The question for the next five years is how these AI companies will generate profit, let alone break even. The hype around AI seems to be a financial, societal, and economic gamble that might turn out for the worse. There are many questions about the future of AI, but one thing is certain: there will be a lot of pain before profit.