The Semiconductor Industry

Source: CDI Global

Semiconductors are the foundation of modern electronics and AI. Through this article, we will explore their production, market dynamics, and the escalating tensions between China and the US that threaten the global supply chain.

What is a Semiconductor?

Semiconductors are key components of electronic devices. They are used in computers, home electronics, the automotive industry, industrial manufacturing, and more. The global reliance on semiconductors comes from their unique property of being able to both insulate and conduct electricity. Typically made from silicon, but also germanium or gallium arsenide, semiconductors are the building blocks of microchips. They are mainly used to build tiny transistors along computer chips. Transistors are essentially switches on computers that either allow or block electricity from flowing, sending a binary signal. As you can imagine, chips need millions to billions of these tiny transistors to run complex programs and computations. In fact, NVIDIA’s newest AI chip, the Blackwell B200, has a stunning 208 billion transistors. AI chips differ from standard chips in their purpose and design. For the Blackwell B200 and other AI chips like it, high transistor density is crucial for performing the vast number of calculations needed to train advanced AI and large language models (LLMs). There are three types of AI chips on the market: GPU chips, FPGA chips, and ASICs. GPU chips are primarily used for the “initial” training of AI models, performing the trillions of calculations relatively quickly and cost-effectively. FPGA chips are used for “inference”, or deploying AI models and applying them to the real world. ASICs are custom-designed chips optimized for specific tasks, capable of outperforming GPUs or FPGAs in terms of power efficiency for dedicated AI tasks. Each of these three chips can be tens of thousands of times more efficient at training AI models than regular CPUs, making them a necessary purchase for any company looking to train its own model.

Fabrication

Semiconductors are made in specialized facilities called fabs (fabrication labs). More powerful chips require smaller transistors, which in turn require smaller and smaller semiconductor “wafers.” This necessitates more advanced equipment to manufacture them, driving the prices of fabrication through the roof.

A wafer is a very thin slice of semiconductor material that serves as the base for manufacturing semiconductor devices, such as chips. The most common way of producing wafers is through the Czochralski process, where ultra-pure silicon chunks are melted down, and a tiny, already crystallized piece of silicon is inserted into the molten silicon. Then, it is slowly pulled back outward, allowing the rest of the silicon to harden around it. This ingot is then cooled and sliced into thin wafers.

The wafer is not yet semiconductive and must go through further steps, including oxidization, photolithography, etching, doping, and layering, before it is ready to be shipped out. Each of these steps requires extremely specified and precise machines.

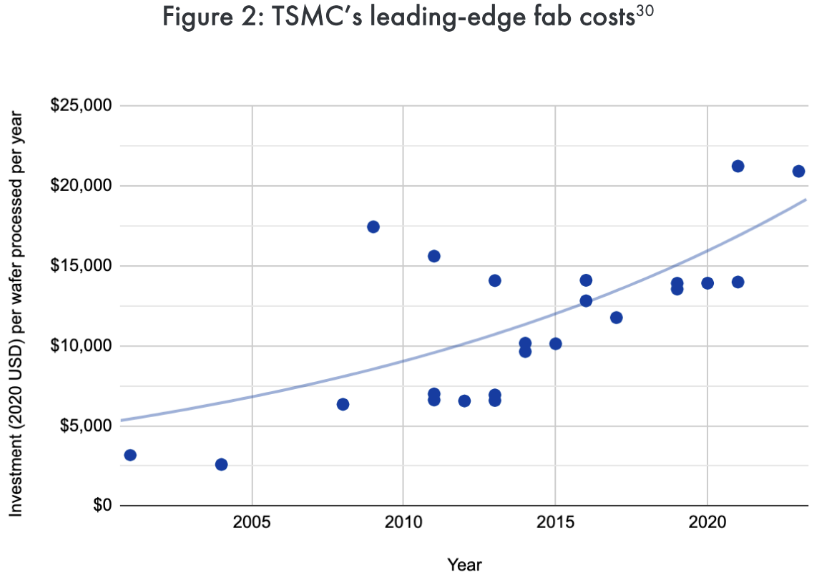

Source: CSET

This graph illustrates that the prices of silicon wafers have risen dramatically over the past two decades, increasing nearly 300% for TSMC, Taiwan’s leading semiconductor manufacturing corporation.

The Semiconductor Market

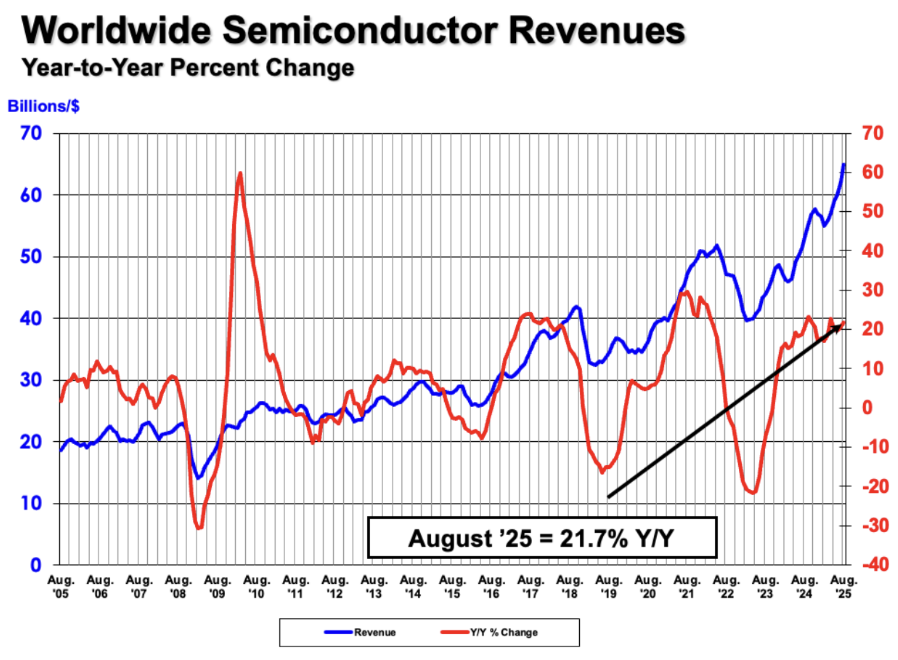

The semiconductor market is one of the largest and fastest-growing in the world. In 2022, global semiconductor sales reached $574 billion, and are projected to double to $1 trillion by 2030. The upward growth of the market has only continued, and as of August 2025, semiconductor sales reached $64.9 billion. The United States and China are the top buyers, accounting for 25% and 24% of the market, respectively, followed by the EU at 20%.

Source: WSTS

This chart, provided by the World Semiconductor Trade Statistics, shows the exponential growth of the semiconductor market.

While US companies dominate the global markets, holding 50.2% of global sales in 2023, the most of any country's semiconductor industry, leading US firms such as NVIDIA and AMD design and sell the chips globally, but do not produce any chips domestically. They are known as “fabless” companies.

92% of the world's most advanced semiconductor fabs (producing wafers less than 10 nanometers thick) are located in Taiwan. The other 8 percent are located in South Korea. In addition to dominating advanced chip production, Taiwan and South Korea combine for 33% of the worldwide production of 10-22nm wafers, 54% of 28-45nm wafers, and 41% of >45nm wafers. The heavy concentration of manufacturing facilities in such a small geographic area leaves the global supply chain very vulnerable to any disruptions, like the 2020 pandemic.

In 2022, the US passed the CHIPS Act, establishing the “Creating Helpful Incentives to Produce Semiconductors for America” fund to reduce reliance on foreign manufacturing. This fund will provide 24 billion dollars to American semiconductor companies in 2022, with 19 billion of that allocated just for manufacturing, and will continue to provide ~6 billion dollars annually until 2026, as well as providing tax cuts to investments in advanced semiconductor fabs. The goal of this is to kick domestic semiconductor production into full-gear by incentivizing foreign investors such as Samsung and TSMC. The act has been widely successful, with over 80 new manufacturing projects being announced across 25 U.S. states, and garnering an estimated $450 million in private-sector investment.

The Trade War

In 2022, in an attempt to weaken China’s growing AI program and based on concerns of its potential use to create weapons to threaten the US and its allies, the US Department of Commerce announced harsh export controls targeted at China’s AI development and chip manufacturing efforts. These controls included an “entity list”, which contained over a hundred Chinese companies, including tech giants like Huawei, that other companies would be required to get a license from the US government before selling US products or any product made with US products, such as Microsoft or Apple operating systems, targeting the majority of semiconductor and tech goods. As a result of these controls, China’s semiconductor sales fell 31% in 2022, according to the Semiconductor Industry Association.

In 2024, after one of Taiwan Semiconductor Manufacturing Company (TSMC)’s chips was found in a Huawei AI processor, the company stated that it may be unable to prevent its chips from ending up in China, despite US export controls. Its limited visibility into downstream usage makes full compliance difficult, increasing the risk of violating sanctions, even unintentionally. In response to this, the US Government barred TSMC from selling any 7nm chips to Chinese companies, in an attempt to crack down on China’s AI efforts.

In October 2025, US lawmakers released a report calling for expanded chip export curbs on China, arising from fear of Trump's potential trade talks with the nation. They suggested a wider entity list and having any Chinese company wishing to buy semiconductor manufacturing equipment (SMEs) apply for a license with the assumption that the US government would almost always deny the request, as well as wanting to restrict fabs that use both Chinese and US SMEs. If their requests are heeded and codified, it could permanently cripple China’s ability to produce competitive semiconductors and computer chips.

China’s Rare Earth Ban

On October 12th, 2025, China imposed curbs on rare-earth mineral exports, many of which are essential in the fabrication of semiconductors. Firms must first gain permission from the Chinese government in order to ship any material containing as little as 0.1% of Chinese minerals, explicitly including minerals crucial to the construction of computer and AI chips.

US President Donald Trump has retaliated on his social media platform Truth Social, stating that “starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China”, in addition to export controls on “any and all critical software”.

Source: Truth Social

President Trump’s full Truth Social post in response to the Chinese rare earth ban.

The mineral curbs and threats of increased tariffs have already had a disastrous impact on the economy, with the S&P 500 down 2% and the Semiconductor sector as a whole falling 8%, AMD down 8%, Nvidia down 4%, and Intel down 3%, as well as erasing nearly 2 trillion dollars in equity values in one day.

These fluctuations demonstrate just how volatile the semiconductor industry truly is, and since the US does not produce nearly as many chips domestically as countries like Taiwan and China, it leaves the United States at the mercy of these foreign powers.

On Sunday, October 12th, China said that it was “not afraid” of a trade war with the US, in response to President Trump’s retaliatory tariff threats. For now, the full implications of these developments remain to be seen, as much is still unknown about the greater effect these events will have on the stock market and global semiconductor industry.