The Rent-and-Invest Myth:A Skeptical Look at Gen Z’s Market Mindset

Source: Yieldstreet

Beyond the Numbers

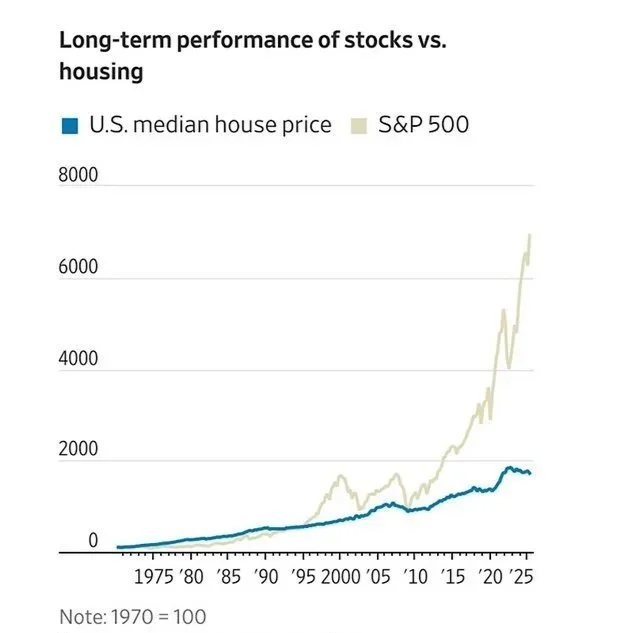

With mortgage rates at their highest since the 1980s and inflation eroding real wages, Gen Z (people born between 1997-2012) has turned to the stock market for refuge. The familiar format of trading platforms like Robinhood Investments and the rise of “finfluencers” have contributed to the investment psychology of Gen Z. Carol Ryan’s W all Street Journal article “Where Have All the Young Home Buyers Gone? Check the Stock Market” captures Gen Z’s generational pivot from real estate to equity for investments through data, arguing that a 9 percent average annual return can and does rival the long-term profit from homeownership.

The numbers add up on paper, but markets exist beyond the dimensions of a spreadsheet. The article over-quantifies Gen Z’s financial decisions regarding investments, assuming their decisions are precisely calculated and grounded on the basis of choice rather than necessity. With increasing housing costs, the burden of student debt, and stagnant wages, homeownership has become a luxury few can afford. What appears to be financial literacy may in fact be financial adaptation to an economy that has priced stability beyond reach.

The Allure of the Quantitative View

First and foremost, despite most of the data supporting this debate, much of Gen Z is too young to enter the housing market, currently facing the burden of their student debt and increasing rent against stagnant wages. Owning a home isn’t rejected out of choice but rather lack thereof.

For Gen Z, investing has become both a form of survival and a symbol of autonomy. Investing apps mirror the loop-like, instant, data-driven aspects of entertainment platforms, making their participation in the markets feel democratic and empowering. According to JPMorgan Chase, 37 percent of 25-year-olds held investment accounts in 2024 versus a mere 6 percent of the age group in 2015. Their surge in market participation underscores a generational shift from labor-based to asset-based means of economic mobility.

Sources: Federal Reserve, FactSet

Though this confidence masks a sense of insecurity. For many young investors, stocks are a better alternative, not because of mitigated risk but because the housing market feels unattainable. The quantitative data offers an illusion of control in a market defined by volatility and lack of stability–producing a generation conditioned to optimize for short-term gains rather than long-term security, a stark difference that leads to economic consequences.

Gen Z’s spending and saving habits reveal the tension between optimism and instability. Many invest before having set aside savings, chasing fast gains and flexible lifestyles all in the name of being “recession-proof”. The focus has shifted from “doom-spending” to opting out of luxuries altogether. According to an annual report from Bankrate, cited by Fortune, 47 percent of Gen Z do not hold an emergency fund, and 27 percent carry more debt than savings. Meanwhile, Glassdoor reports, since 2016, record low job insecurity among Gen Z workers with entry-level positions–most susceptible to recession layoffs. Analysts predict that the 2–3 percent mortgage rates seen during the pandemic–driven by COVID-19–are highly unlikely to return, leaving future buyers facing permanently higher borrowing costs.

Older generations, on the contrary, built wealth through steady work and gradual ownership. As Rob Williams, a managing director at Schwab Center for Financial Research, notes, “A home is an illiquid asset [...] You don’t have easy access to housing equity the way you do with stocks, so there is a trade-off to tying up that money.” Yet while equities offer liquidity, they lack leverage in the sense that you cannot borrow 70 percent of the price of equities or stocks to purchase them, whereas with a home, you can. Today, success is measured differently: less by permanence and security, more by profit, mobility, and the illusion of financial freedom.

The Missing Variable

A stock portfolio can grow, but it can’t keep you warm. Quality of life remains the missing variable in this debate. The fixation on returns ignores what homes offer that a stock portfolio can’t: stability, community, and belonging. Homeownership ultimately forces savings, provides tax advantages, and protects against rising rents. Renting, even under fixed leases, leaves individuals absorbing every future inflation shock with no accumulated equity to offset it. Yes, homeownership comes with taxes and maintenance, but it also establishes community. In a culture defined by volatility, owning a property where you can build equity remains a primary form of long-term investment and security–this is the difference between the measurement of appreciation versus assurance.

Historical Echo

While many skeptics argue this behavior isn’t anything new, that every generation has questioned the value of buying a home, but today’s economy is different. Baby Boomers built wealth during eras of strong wage rate growth and reformations; Gen Z has inherited record debt supported by few safety nets. Gen Z’s rejection comes at a darker time in an economy that seems more fragile than cyclical. While older generations built wealth on stability, Gen Z is building wealth amidst uncertainty. This is a reflection of economic exhaustion: a generation priced out of ownership and funneled into a market based off of promised liquidity but instead delivering anxiety and inconsistency.

A Future You Can Live In

The homeownership rate amongst Gen Z (just 16 percent) is skewed by age range yet reveals a greater shift. That being said, so far, Gen Z’s financial habits reflect both ingenuity stemming from economic exhaustion and the constraints of inflation, student debts, and digital markets, which they’ve learned to maneuver. A home may never outperform the S&P 500, but it offers something no stock portfolio can–a future you can actually live in. In the end, real wealth isn’t measured only by profits but by sustainability when all else fails and feels temporary.