Silver Price Reaches New Peak

Silver Boom

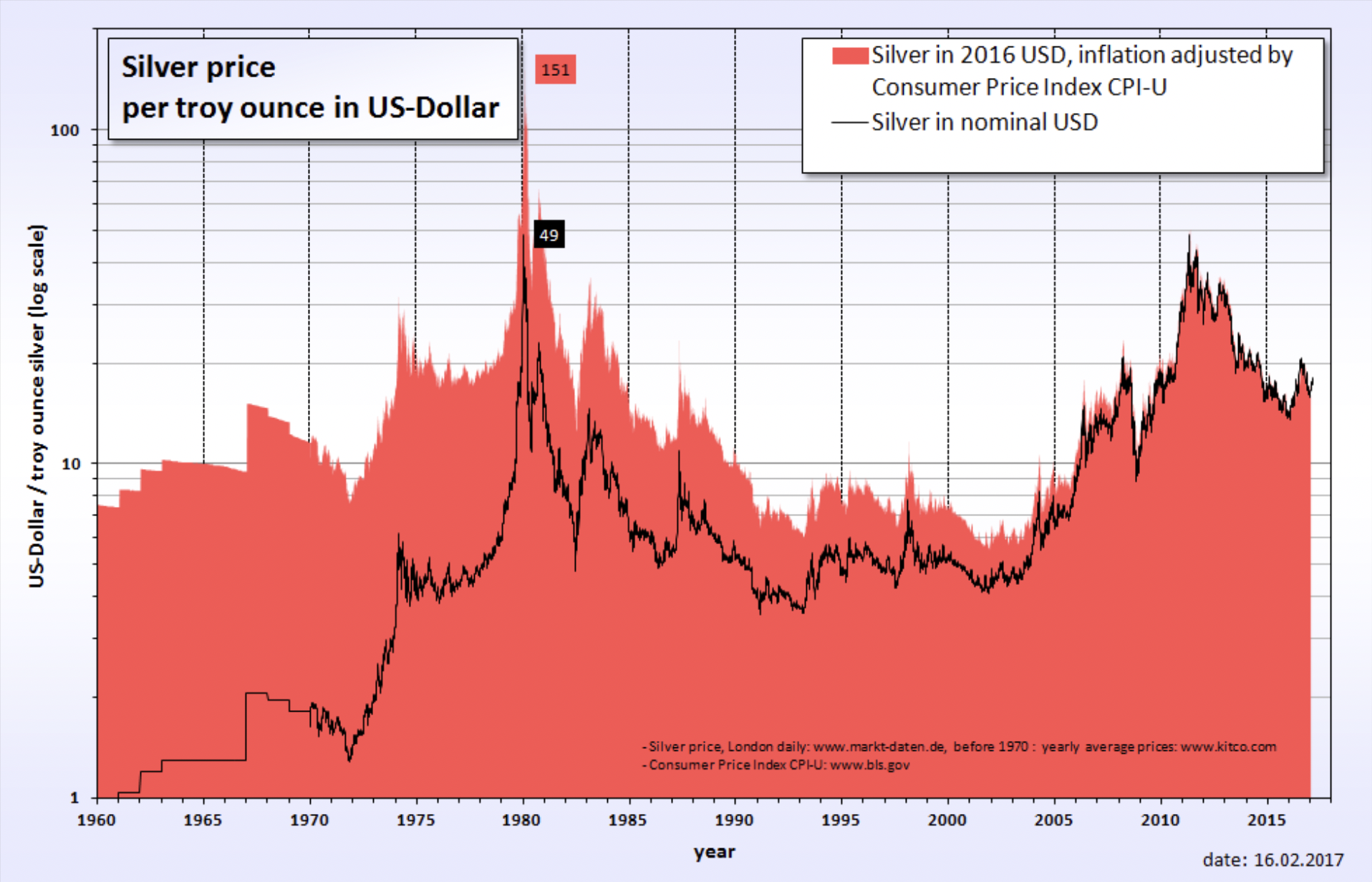

According to the Wall Street Journal, silver prices have reached an all-time high for the first time in forty-five years, now trading at roughly $53 a troy ounce (A troy ounce is a unit of weight equal to 31.1035 grams, primarily used for precious metals like gold, silver, and platinum). This sudden increase—higher than the previous peak in the 1980s at $48.50—is caused by supply constraints, market conditions with interest rates, industrial applications, and concerns of tariff policy.

Context

Silver has reached highs in the past like this, met by sudden corresponding crashes. In the 1980s, silver’s price surge was curbed by regulators, causing prices to collapse. The price of silver fell similarly in 2011 following the financial crisis. As seen in 1980 and 2011, after the sharp increase in silver, a sharp decrease quickly followed. These historic price drops may scare some people from investing so fast in silver. If this is the case, people may never capitalize on this silver high for fear of the looming drop, causing a supply that is unable to match the new demand.

Supply Constraints

One reason for this sudden rise in the price of silver is the declining real interest rates. When interest rates fall, this makes firm assets like silver seem more appealing as the opportunity cost decreases. Currently, many people believe that the US dollar is weakening and job market conditions are signals that the Federal Reserve will cut rates. Lower interest rates usually mean the price of metals is going up.

The price rise is also caused by the supply being down. For example, London vaults have fallen to their lowest levels in the past decade, and some dealers have been charging premiums over future prices for physical delivery. We can also see that the silver borrowing rates have spiked recently. If inflation surprises recede or central banks pivot to tightening more aggressively, real yields may rise, pressuring silver downwards.

At the same time, with global uncertainty on the rise, the appeal of silver is increasing. Silver is very vulnerable to shifts in interest rates. If the Central Banks tighten policy, we could see the demand for metals go down, causing silver’s price to follow suit. If industries are able to stray away from silver or find a way to use less of it, we could see the demand go down drastically.

Industrial Applications

Silver is different compared to other metals like gold because it acts as a precious metal that is traded (silver per troy ounce vs gold per troy ounce) as well as an industrial commodity. Over the years, silver's role in clean energy has increased, making it an essential industrial piece. With the input prices rising for industries like solar manufacturing (which use silver extensively), solar companies may consider alternatives now, leading to an R&D boom and shakeup of industry players if an alternative is found. Furthermore, we see silver used in many everyday objects, such as iPhones, due to its excellent electrical conductivity and corrosion resistance—two positives for use in expensive machines.

Like all precious metals, silver has to be mined, yet demand for silver right now does not match the mining capacity of the metal. The resulting price increase may mean people invest significant amounts to create technological breakthroughs to help mine more efficiently, or new laws are considered for increased mining that will help supply match demand at a cheaper price.

Tariffs

Another uncertainty and risk that comes with silver trading and exchange is the recent policy on tariffs. As silver is a precious metal that is mined primarily in Mexico, China, and Peru, tariffs by the US can greatly impact the price of the metal import.

Furthermore, like gold, many people view silver as a long-term commodity. President Trump's tariffs have been difficult to predict for some people, causing people to be more reluctant when investing in something like silver. Bullish investors likely will hop on the silver train right now, while more reluctant investors will likely search for the silver bullet that could cause silver’s price to decrease.

Projections & Summary

However, some major banks, such as Bank of America, predict silver will continue to gain value. They have predicted that silver will continue to be around the $65 mark. Others think a major pullback will occur and silver will drop to the approximately $35-45 range. Both seem very possible, but nobody knows for certain what will happen. Silver’s climb to a new record high in 2025 symbolizes more than speculative exuberance; it reflects a shifting global economy where tangible assets and industrial metals gain prominence amid uncertainty.

The loose monetary policy, growing green-energy demand, and constrained supply have propelled silver into a new phase. Yet history cautions against unbridled optimism. Each prior boom in silver has eventually corrected sharply when fundamentals or sentiment changes occurred. Whether this rally proves sustainable will depend on how inflation, real interest rates, and industrial innovation evolve. For now, silver’s ascent captures a moment of transition in the global markets, a tangible expression of the tension between financial speculation and the real economy.